The Big Squeeze

I’ve had a few friends ask what is going on with Gamestop and the stock market!?!

Well, let me explain.

First, let’s understand what on earth does it mean to ‘short’ a stock? Shorting a stock is when you borrow shares of stock from a broker and sell it immediately at the current price. You still owe those shares of stock back to the broker. The idea is, you believe the stock’s price will fall in the future- therefore allowing you to buy back the shares you owe, at a lower price. But, you get to keep the difference.

Let’s walk through an example; Let’s assume I want to short the stock XYZ which is currently trading at $100. I borrow 10 shares from my broker and they get sold immediately at $100/share, totaling $1,000. I now have $1,000, but I still owe my broker those 10 shares I borrowed. Now let’s assume some time in the future the price of XYZ drops to $90. I could then ‘cover’ (essentially buy back) my 10 short positions at that $90 price, totaling $900. The 10 borrowed shares are immediately returned back to my broker. I made $1000 when I sold the borrowed shares (when the price was $100), but I only had to pay $900 to buy back the shares needing to be returned. My profit is the $100 difference.

BUT, what if the price of XYZ doesn’t actually go down!?! Following the same example as above- let’s assume the stock price of XYZ went to $120 a share. In order for me to cover my short positions I would have to buy 10 shares at $120, totaling $1,200. Clearly I lost $200 in this scenario. Since the price can rise indefinitely, the loss can become unlimited!!

So what’s happening with Gamestop- (GME), and AMC, BB, NOK…. Someone within the r/WallStreetBets subreddit saw that a hedge fund had taken out a massive amount of short positions against Gamestop. So think about the example I gave above, but invovling billions.. The subreddit community rallied and convinced everyone to collectively buy as much Gamestop stock as humanly possible. This sky-rocketed the price (laws of supply/demand) and, more so, the short positions the hedge fund held started to lose billions. Melvin Capital was the primary company that fell victim, but there certainly are many others out there. I’ve seen reference to varying numbers, but based on the short percentage on Gamestop alone was in the range of $13 Billion.

The super rich running these hedge funds are now getting a taste of what they have been doing for years with all kinds of market manipulation.

**UPDATED (1/28/21)

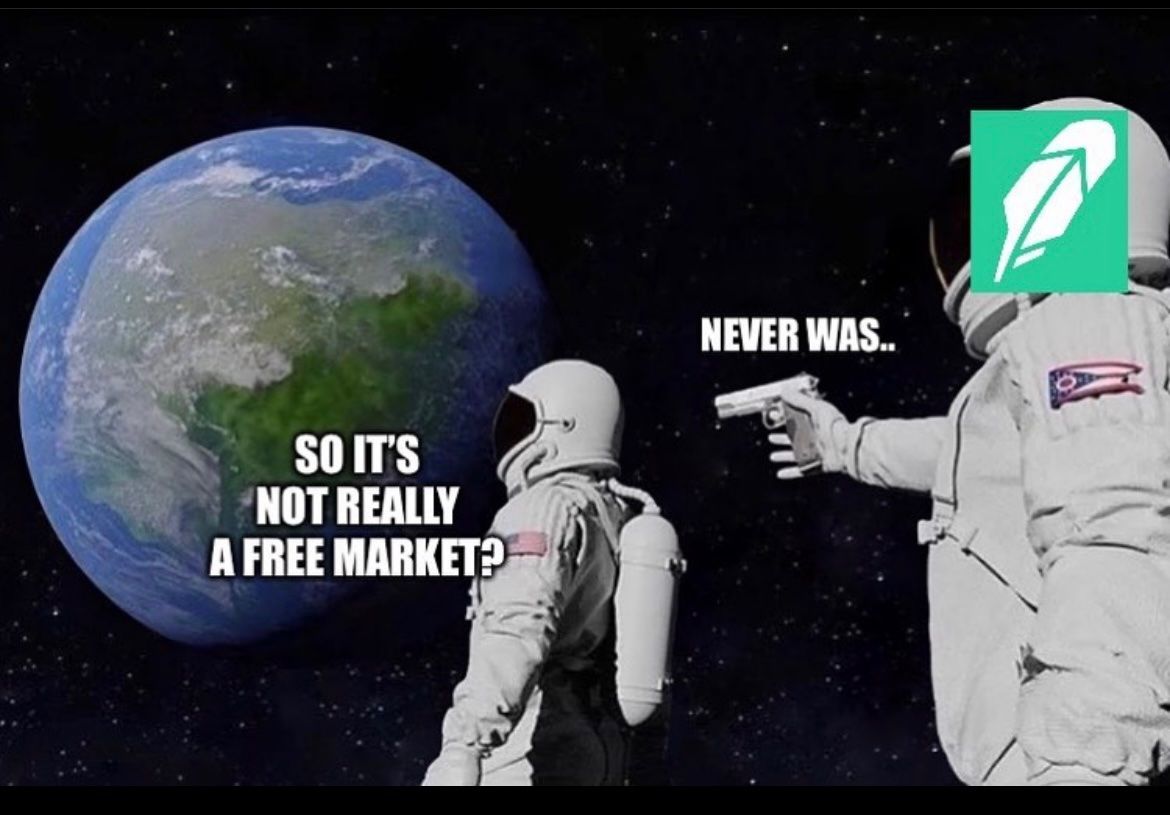

Some brokerage firms outright prevented retail traders from submitting buy orders (they could only sell), yet they still allowed institutional traders the ability to buy & sell. Thus allowing the short sellers to cover their positions. Once again, Wall Street and Billionaires are allowed to do whatever they want- I guess it’s only truly a Free Market for the top 1%…

I have 3 thoughts/comments/takeaways:

1- It’s great to see the exponential growth of retail traders. At one point, I remember seeing a statistic that the top 20% of households owned just over 92% of wealth, by way of the stock market. And the top 1% owned well over 60%. This is just stock wealth, overall wealth distribution is a different story and even more shocking. So, it’s good to see the barriers of investing being broken down. However, I am seeing a lot of reckless investing happening, so I hope those newer to investing also take time to understand fundamentals and risk- it can be brutally unforgiving.

2- The practices of Hedge Funds are getting more exposed because of current events. Many of the hedge funds have astronomical amounts of buying power- in the billions. They also do lots high volume of over-the-counter deals/transactions, including short selling stocks. Then they turn around and publish/push their “research” as to why certain stocks will move in a certain direction. Meanwhile, there’s an alternative motive for their research. Thus leading to millions in profit for them.

3- Part of the outrage is the fact brokerage firms started to place restrictions on retail traders from placing trades, but continued to allow institutional traders to buy- in order to close out their short positions. So, all of a sudden the rules changed to accommodate the billionaires and Wall Street. Those who fought tooth and nail to prevent additional regulation are now demanding regulation in order to save themselves.