Fundrise: 5 Years later

TL;DR: Fundrise has great potential, but after a full 5 years of investing and losing money- I’m liquidating a majority of it1. It’s not for me, but it could be for you. I’m posting this mainly for those who are beginning their journey and exploring Fundrise as a long-term investment option.

Disclaimer: This is not financial advice and contains my opinion, layered with facts and data, with a strong emphasis on “my opinion”.

8 Jan 2024: Outside of a few angry people with this post, I did have a number of people reaching out and having some great conversations, some of which did disagree with certain aspects and many agreeing. Thank you to those who were able to communicate properly with civil conversation versus attacking with accusations and assumptions. Because of these conversations, I wanted to take more time to make updates and revisions to this post to provide even more details and clarifications. A summary of these updates can be found here.

5 Jan 2024: I had a unhinged person claim this post to be verbatim an “attempted takedown of Fundrise” and claiming I am a liar. This is completely inaccurate, made up, and honestly I’m not sure how they came to this conclusion. This post is my opinion mixed in with my own personal experience. There is zero benefit and zero harm for me to share my experience and my opinion, especially on my own website. If this post doesn’t help you, no a problem at all, simply move on. If you found value in the post, that’s awesome! If there are any errors or questions- I would love to engage in normal conversation as adults, otherwise- again, simply move on. Outside of this, always invest at your own risk, regardless of platform used or investment vehicles and always perform your own due diligence before investing in anything.

For starters, Fundrise is an online investment platform that allows individuals to invest in real estate and venture capital. To learn more, visit their website.

I’ve been a long-time supporter of Fundrise and still am. The very idea to democratize investing in real estate with very little capital is no easy feat. And this is where Fundrise easily stands out as one of the best options to invest in real estate with lower levels of capital.

I’ve been investing and active trading in the stock market for the last 18 years. I consider myself relatively successful as a retail investor, but humbly I do not know everything and there’s always more to learn. I heard about Fundrise around 2018 when I was beginning my own journey to start investing in real estate and decided to engage in an experiment with Fundrise to see how the platform operates and if this is something that could be worth investing in for others. In short, this does and will not work for me, but maybe for others.

This is not a review of Fundrise, but rather my personal experience (and my opinion) and the performance of Fundrise over a 5 year time period. If you are looking for a good review of Fundrise, head over to, Nerdwallet. They have great write-ups and reviews on Fundrise if you’re looking for that.

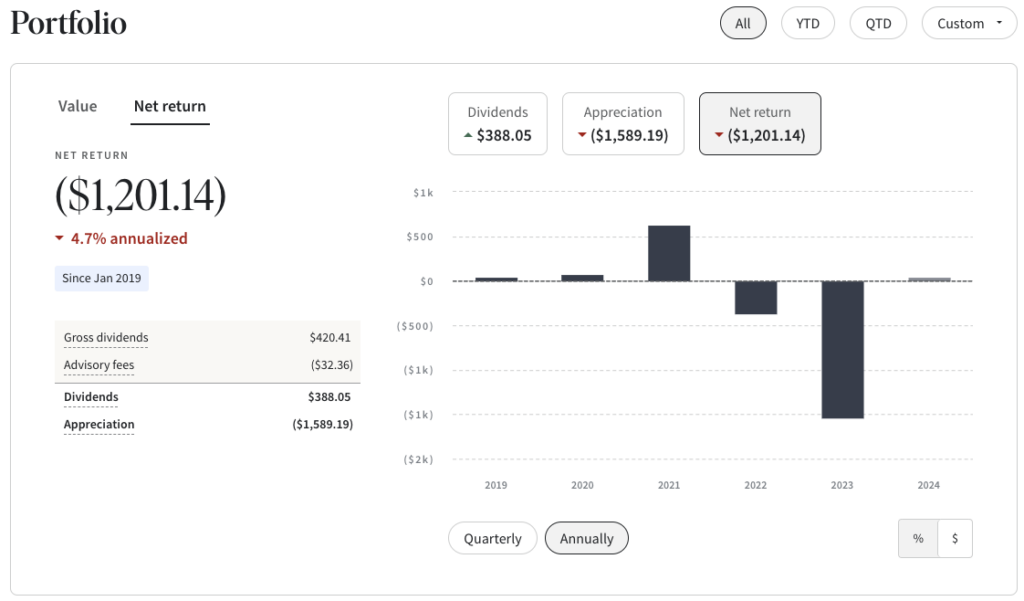

For starters, here the snapshot of my account when it comes to returns after investing from January 2019 to January 2024:

Over the course of the full 5 years, I have invested just under $20,000 and as of Jan 2, 2024 my account is down 4.7%, a net lose of $1,201.

I started initially with $500 in Jan 2019 and have had auto-invest enabled. With auto investing, I started with a lower amount monthly and at the highest point I was doing $400 every 2 weeks. For clarity, $20,000 was not invested the entire 5 years, as I did not do a one-time investment in the beginning.2 It’s important to understand in my situation, the amounts of the contributions were gradually increasing over time. Because of how I invested and the timing of the market, this meant an increasing amount of the contributions were higher on the backend of the 5 year timeframe. If I had instead, invested the $20k up front on day one and zero contributions thereafter, it is highly likely my Fundrise portfolio would have had a positive net return.3

I also invested into the iPO twice, in August 2020 and March 2022- around $1,000 each time. I also contributed into the Innovation Fund in August 2022 with $2,000. I also had dividend and NAV reinvestment turned on. So, no funds were ever withdrawn- all reinvested back into the respective funds. Lastly, and possibly the most important- I selected the “Long-term growth” investment plan, which has a short description of “Pursue superior overall returns over the long term. This plan is focused only on real estate assets.”4

With the investment plan of Long-term growth, my Fundrise portfolio allocation at the end of the 5 year period was the following5:

| Fund Name | Portfolio Allocation |

| Growth eREIT | 1.61% |

| East Coast eREIT | 1.33% |

| West Coast eREIT | 0.21% |

| Growth eREIT II | 4.67% |

| Development eREIT | 9.11% |

| Growth eREIT VII | 7.58% |

| Flagship Real Estate Fund | 69.96% |

| Income Real Estate Fund | 5.54% |

I would like to highlight, in my opinion, the 4 key factors as to way my portfolio after 5 years is negative6:

- Poor Performing Fund Allocation. Over 86% of my portfolio was made up of poor performing funds for the last two full years. This allocation was rather consistent for years 2022 and 2023. Here’s the top three funds, by allocation, held in my account:

| Fund Name | Portfolio Allocation | 2022 Total Return | 2023 Total Return |

| Flagship Real Estate Fund | 69.96% | -1.9% | -11.8% |

| Development eREIT | 9.11% | -1% | -9.7% |

| Growth eREIT VII | 7.58% | -4.1% | -12.2% |

- Gradually increasing investments. On the coattails of the above item, I started the account with $500 and auto-invested every month, gradually increasing the investment amount every month over time. It’s fair to say more than 50% of the total contribution amount was invested in the last 2.5 years of the total 5 year timeframe. This played a big factor into things.

- Low Allocation to top performing Funds in 2021. For 2022 and 2023 the allocation year-over-year remained rather unchanged (see item #1 above). It appears no more than a +/- 5% variance changed between 2022 and 2023 portfolio allocation. However, in 2021 I had a very low allocation for two of the top performing funds: The Flagship Real Estate Fund (this was called the “Interval Fund” at the time), which returned 29.3% in 2021 and the Growth eREIT II fund, which returned 34.3% in 2021. I had to hunt through my statements for this, but it wasn’t until August 2021 that some auto-invest contributions starting going towards the Growth eREIT II fund and it remained at a low allocation up until this day. And it was a similar story for the Flagship Real Estate Fund (aka Interval Fund) with auto-invest, which didn’t start happening until Oct 2021.

- Terrible merges and reinvestment timing. In Q4 of 2021 and Q1 of 2022 is when there seemed to be a lot of merging out of funds and loading up the Flagship Fund. It’s almost like management of my account was setup to fail. I do not believe this happened on purpose at all, just poor timing and the creation of a perfect storm for my portfolio. This was a move that was extremely lagging behind actual market conditions when it should have happened 2-3 quarters prior. As just mentioned, a very little amount was allocated into the Flagship Fund (formerly called the Interval Fund) in 2021 and majority (almost all) of that small allocation started to happen in Q4 2021. From this point on well into 2022, almost all merge transactions were out of various funds and merged into the Flagship Fund. This was happening way too late. The Flagship fund already had an outstanding 2021 year- I already missed the boat. Additionally, 100% of dividend reinvestments throughout 2022 and onwards also went into the Flagship Fund and the Development eREIT fund. Again, two funds that did not do well at all in 2022 and 2023 (see performance in table in item #1 above).

Items 1, 3, & 4 above were essentially how Fundrise was automatically managing the allocation of funds on my behalf, including all of the merges, auto-invest contributions, and dividend reinvestments. As I mentioned, I selected the “long-term growth” investment plan and let Fundrise manage the allocation of my portfolio. The 2nd item above is simply how the auto-investing happened on my part.

At the end of the day, between the 4 items mentioned above, the timing of the investments, and the unpredictable housing and real estate market created a scenario where my Fundrise portfolio simply did not perform well and ultimately led to a negative net return at the end of the 5 year period. The primary takeaway here for me is I should have chosen my own funds and not let Fundrise do this automatically.

Where would I invest instead?

The driver for me posting this was a friend recently asking me where and what could they invest $15,000 in and they actually mentioned Fundrise. Which was funny, because I was going through the liquidation/redemption process with Fundrise.7

My recommendation, invest simply in the S&P 500, some REIT ETFs (if wanting to indirectly invest in real estate), and even look into some some fixed income products, such as some of the high interest CDs currently floating around (as of 1/7/2024, Marcus has a 12 month 5.50% CD). A good combination would go a long way.

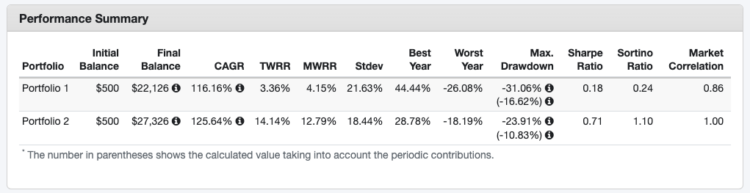

For example, here’s the 5 year performance of VOO (Vanguard 500 Index Fund ETF) and RWR (SPDR Dow Jones REIT ETF), respectively:

Yes, The S&P 500 is nearing the all-time high (ATH) and to clarify, I would not do a bulk investment into the S&P 500, but I certainly would invest a certain amount. Again, this is my personal preference and not financial advice. If the goal is long-term investing and continuing with regular contributions, investing into the S&P 500 has a winning track record. There’s no one on planet Earth that can argue against this. This is also a primary reason various funds benchmark their performance against the S&P 500, including Fundrise (more on that below). You could grab any point in the past 40 years when the S&P 500 was at or near the ATH, at that point in time, and if you were to invest then (we’ll use the VOO ETF as the example again), and continue to purchase additional shares on a regular basis, and allow dividend reinvestment- guess what? You’d have a positive net return. I would encourage you backtest this as much as you like.

Backtesting My Fundrise portfolio vs VOO va RWR8

Let’s do a simple backtest of how my personal Fundrise portfolio performed compared to how the SPDR Dow Jones REIT ETF (RWR) and the Vanguard 500 Index Fund ETF (VOO) would have performed, respectively. This would be using the following parameters: 1/ the same start & end timeframe, 2/ the same initial investment ($500), 3/ regular reoccurring contributions (i.e. purchasing RWR & VOO monthly), and 4/ allowing the brokerage to perform dividend reinvestment (similar to what I was doing in Fundrise).

The one factor not accounted for in the below backtest, is the nature of gradually increasing the amounts of the reoccurring auto contributions over the 5 year period that took place. The backtest is simple with the total contribution amount spread evenly over the 5 year period. However, this would not have a material difference in the outcome- RWR and VOO would have still outperformed my Fundrise portfolio.

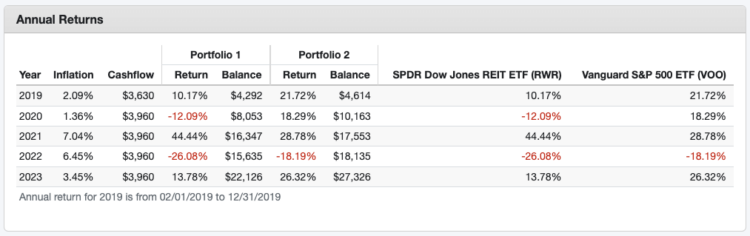

Below are the summary results of a backtest using Portfolio Visualizer (non-sponsored link here)

Note: Portfolio 1 is RWR and Portfolio 2 is VOO

It’s impossible to have a true comparison as these are difference investment vehicles, but hopefully this illustratively helps and is about as accurate as this will get. Unfortunately, I will not spend the time to do actual month-by-month contribution backtesting to align with the gradually increasing contribution amount that was done into Fundrise. If doing so, the results of the backtest would vary the most against RWR, but the trailing 5 years the S&P 500 has clearly outperformed my personal Fundrise portfolio.

| Net Return | |

|---|---|

| My personal Fundrise Portfolio | -4.7% | -$1,201.14 |

| SPDR Dow Jones REIT ETF (RWR) | 10.63% | $2,126 |

| Vanguard 500 Index Fund ETF | 36.63% | $7,326 |

It’s important to note, 2023 was not a great year for real estate, at all. Fundrise summed it up very well in their 2023 year end letter to investors with the following statement:

“The past twelve months have proven to be the single most challenging year for real estate returns since the 2008 Great Financial Crisis…”

Fundrise, 2023 year-end letter to investors

Something to keep in mind is the Fundrise performance from the above backtest is based on my personal portfolio over the 5 years and with dividend and NAV reinvestment turned on. It’s also important to note that $4,000 of my portfolio were invested in the Innovation fund and iPO- which essentially had combined total net return of $26. This means if that $4,000 was actually invested into the REIT funds, things would definitely look different. Only $1,000 of that would have been invested in the eREITs in 2020, the remaining in 2022.

Fundrise Annual Letters to Investors9

I’m going to use the next few paragraphs to tell you a little history on Fundrise and their annual letters to investors that I recently found interesting as I was digging deeper not only into my own statements, but some letters Fundrise put out.

Fundrise publishes an annual letter to investors every year. It used to be common they would map the performance of Fundrise (an aggregate of funds) against the market. But Fundrise is very strategic in how they present this. For example, in 2018 they compared the aggregate Fundrise performance against the Vanguard Total Stock Market ETF (VTI). Not only comparing the current year, they also maintain the running aggregate average performance of Fundrise, since inception. Which is interesting because VTI does not track the S&P 500 (again VOO as an example does) and it turns out that year VOO outperformed VTI. Maybe it was just a random coincidence they happen to chose the lesser performing ETF to benchmark against versus the very common S&P 500. This was the case for 2019 as well. I’ll also call out in 2019’s annual letter was the last year they published a running aggregate of Fundrise’s performance since inception against the market. I wonder why that is? I’d wish they bring back this running aggregate over time of the performance of Fundrise benchmarked against the market and other funds; and continue to include in their annual letter. It just so happened in 2019 that the aggregate Fundrise returns were now underperforming against the VTI ETF and the VQ ETF (Vanguard Real Estate Index Fund).

In 2020, Fundrise published one version of their annual letter and then recalled it removing many of the graphics and comparisons. In their own words: “we received a regulatory request to disaggregate fund returns of the Fundrise portfolio, and to refrain from using specific branded investment products (such as ETFs) as benchmarks for the performance of Fundrise sponsored programs.” We can all agree that 2020 was a rough year globally, but the S&P 500 outperformed Fundrise, yet again. And all of a sudden they didn’t have a side-by-side comparison showing this gap, or the year-over-year running aggregate.

In 2021, Fundrise does not even mention the market in their annual letter, the S&P 500, nor does it benchmark its funds against anything (maybe for the first time). Why? Well, it wouldn’t have fit their narrative, because the market almost double digit outperformed the aggregate performance of Fundrise funds. This makes it 3 years in a row Fundrise has underperformed against the S&P 500. But, surely enough in 2022 the benchmark comparison is back in the annual letter because Fundrise did outperformed the market, along with the side-by-side comparison. But, they’re still not showing the year-over-year and running aggregate comparison. On the to latest letter (2023), and again no mention or benchmarking of anything in 2023’s letter, because the S&P 500 outperformed Fundrise again. I wonder what that running year-over-year aggregate comparison would look like now?

I only went down this rabbit hole, because Fundrise has a narrative to tell with lots of marketing and they do a great job at it. My only takeaway from even mentioning any of this is to really read deeply into everything Fundrise publishes and interpret it for yourself. Just remember, Fundrise is a long-term investment and everyone will not obtain similar results. However, it did bother me that Fundrise only outperformed the S&P 500 once between 2019-2023, and only in that single year did they actually benchmark against the S&P 500.

Fundrise iPO

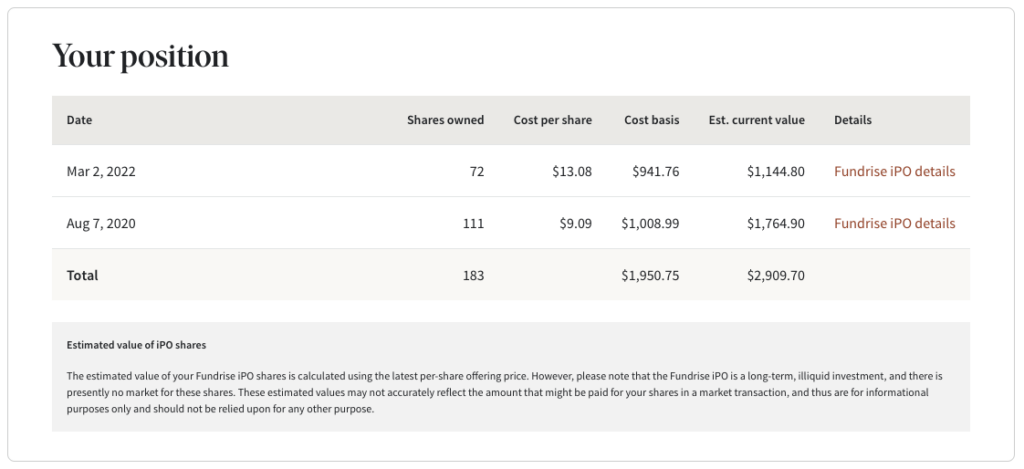

I also want to talk a little more about the iPO that Fundrise has held and the Innovation Fund (discussed lower). As mentioned I participated in 2 of the iPOs Fundrise held in Aug 2020 and March 2022. I technically invested a total of $1,950 between the two iPOs. From my understanding, Fundrise has held 4 of these iPOs allowing existing investors to invest more money directly into Fundrise.

Here’s the perceived value of my $2,000 investment to the Fundrise iPO:

In the beginning, I thought this was an awesome thing, today I’m not so sure. Even though the value is displaying $2,909.70- this is only a perceived value or unrealized gain. However, it’s not really an unrealized gain at all, because if I were to cash out on my investment- Fundrise would only provide the original invested amount. To date, Fundrise has never paid a dividend or has provided any kind of return from these investments for the iPO. This is the case going back to the first iPO held in February 2017. In fact, when reaching out to Fundrise to confirm this I received the following information:

“iPO investors would not be able to realize the appreciated value of their iPO shares without a liquidity event, such as a traditional IPO or sale of the company.”

It’s also important to note the following disclaimer within Fundrise:

The estimated value of your Fundrise iPO shares is calculated using the latest per-share offering price. However, please note that the Fundrise iPO is a long-term, illiquid investment, and there is presently no market for these shares. These estimated values may not accurately reflect the amount that might be paid for your shares in a market transaction, and thus are for informational purposes only and should not be relied upon for any other purpose.

I get this is a long-term investment, so this is understandable to a degree. But, my personal concern is there’s not enough transparency with Fundrise around the strategic direction of the organization10. Such as, what is the actual value of the organization? Will there ever be any realized gains from these investments, from a strategic stance? Do they plan to operate as a private company with no vision to ever go public or sell? If the later is the case, I would have second guessed investing in their iPO because there is no true value in it. Someone on Reddit mentioned I should have “read the prospectus”, this type of info would never be in a prospectus- because there is no such thing as a prospectus for the iPO11. Only a subscriber agreement and again this type of info would never be in there and is not in there. It’s essentially an interest free loan the investor is giving to Fundrise with no guarantee of a return, except for a perceived value and the off chance there’s a liquidity event.

Fundrise does their best to make you aware of this with the iPO. But, for a platform that is aiming to democratize real estate investing and targeting consumers with less capital to invest- to me this is a bit conflicting.12 I also want to point out and give credit to Fundrise for creating a separte annual letter addressed to the iPO investors. This started in 2021 for the 2020 year. I do believe these read well and does give a very high level view into the health of the Fundrise as a company. However, these letters tend to focus on only AUM, number of active investors, and number of employees. They have never mentioned revenue until the 2022 letter. No mention of any kind of liabilities, gross profit, or operating expenses. So the revenue number is a bit hard to actually interrupt by itself.13

I hope I am wrong. And I really mean this. I’m hoping to come back to this post in years from now to say I was wrong and the iPO was one of the greatest investments I made. Most importantly and full disclosure, even though I am liquidating my Fundrise account, I am actually liquidating the eREITs and the Innovation Fund, but not the iPO. So hopefully, I am wrong and one day my “long-term investment” will generate a positive net return.

Here’s the perceived value of the Fundrise price-per-share over time:

Fundrise is claiming it’s own share price has had a 218% increase since the beginning of 2017. I personally believe there is no straight-forward data that is provided to investors to help them understand this valuation and as mentioned already, there’s no strategic directional information shared with investors to better understand this or the full picture of financial health of Fundrise.

Innovation Fund

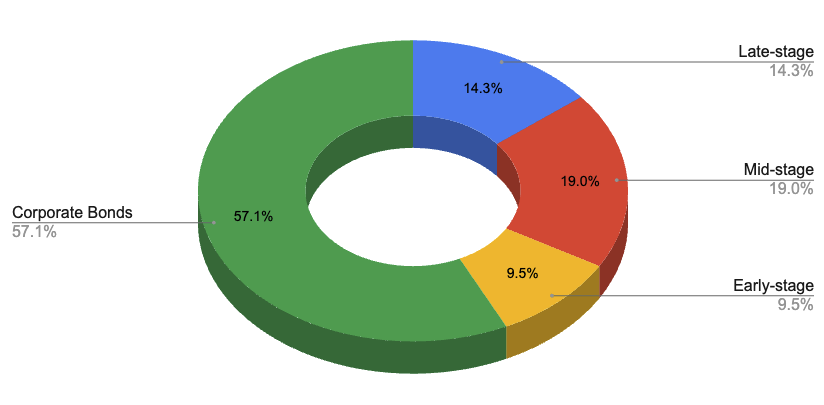

As for the Innovation Fund, I personally don’t have much to say about it as I have only been invested since it’s inception in August 2022. So, before reading on keep this in mind, I only was invested into the Innovation fund for 16 months. At first, I had mixed feelings. On one hand, I originally came to Fundrise for real estate investing solely, so I did not care about the idea for this fund. On the other hand, it admittedly was exciting and I respected Fundrise for essentially democratizing yet another area that’s difficult for lower capital investors to participate in- venture capital. I decided to invest with a relatively smaller investment of $2,000 (relative to the current value of the real estate investments of my Fundrise portfolio).

I ultimately decided to liquidate the Innovation Fund in my portfolio. The primary driver was the distribution of investments being made. As of January 2024, the above chart is essentially the makeup of companies (not dollar amounts, but keep reading) that were invested in with the Innovation Fund. I personally, am not a fan of over 57% of the organizations being invested into being established organizations through corporate bonds, many of which are publicly traded organizations. Just to name a few of these organizations: Twilio, Block, Uber, Cloudflare, and Splunk. I would much prefer that these types of investment were held to an extreme minimal as you can simply go to any brokerage firm and invest in these respective companies.

To paint a better picture of this and actually make matters worse, as of June 30th, 2023 (latest info as of 1/3/2023) only 27% of investments (dollar amount) of the Innovation fund is actually invested in equities of companies at various stages. The remaining amount is invested in fixed income through established organization’s corporate bonds and over 47% of the entire Innovation Fund is sitting as cash in a government-backed money market! This was a bit alarming to me. You can find all Innovation Fund information here. To be fair, again the Innovation is relatively newer, so it makes sense that maybe a start-up just simply did not catch the attention of Fundrise- especially in the current macro economic environment.

Ultimately, my $1,950 investment in August 2022 yielded a net return of +1.3% ($26) over a 16 month time period. Which is not bad, but not by any means great. Just for comparison, I could have thrown this into a 12 month high yield CD and at maturity put into a 6 month high yield CD- this would have easily 4x my return, compared to the Innovation Fund.

Even with everything above mentioned, it’s important to note that the Innovation Fund is relatively new and it started during possibly one of the worst times to start such a fund as the current macro economic environment is not really conducive to venture capital, particularly in tech. I will say, in my opinion, this fund has a ton a great potential, it just needs to get a little less conservation with the fixed income and liquid holdings.

In Conclusion

Investing is a gamble. The lower the risk, the lower the returns. And Fundrise is not only risky, but you have little to no control. 2023 has turned the real estate investing market into a nightmare. Majority of my loses in Fundrise were due to 2023- and I essentially had zero control over it or the ability to take immediate corrective action. This essentially is the primary driver why I would not recommend Fundrise. Not because of the performance (this will vary based on several factors anyway), but rather the lack of granular control and lack of flexibility. This is entirely my personal preference.

Some key takeaways from my personal experience

- I stated I would not recommend Fundrise previously, but this based on my experience aligning to being a retail investor along with other personal preferences. Namely, greater flexibility and control. Also things like more advanced order entry, such as selling covered calls on LEAP contracts or setting active orders with trailing stop losses to protect profits. The reality is, everyone should consider Fundrise! It opens new opportunities that are not matched by many other platforms. Just make sure you do your due diligence up front and ensure there’s alignment with your investing objectives and goals.

- If you choose the “Long-Term Growth” investment plan, make sure to closely monitor the performance of your portfolio to continuously ensure your goals and objectives are being met. Keep in mind if you enable dividend reinvestment, those dividends will go into funds aligning to your investment plan you choose, not the funds in which those dividends came from.

- I would recommend you to explicitly choose your own funds to invest in and not rely on the investment plan set in Fundrise. Again, this is based on my experience.

- Understand your investing timeframe. Yes, Fundrise is long-term investment. But, what does this really mean? Reality is there’s no single universally accepted timeframe of what this means. Some resources will tell you anything you hold longer than a year, some say 10 years, it could easily be argued it should be 20 years. Just make you understand what long-term means for you and invest accordingly. If Fundrise was around when I was in college- I would have 100% opened an account and began investing into it.

- This is more of an observation. There were many people who called out they started investing with Fundrise around the same time as I, but they were up by decent margins. Something in common about all of these folks who aligned with this did a one-time bulk investment into Fundrise and not much, if any, additional contributions thereafter. I chuck this up to mainly timing and luck, but it’s something to think about. Just do a single bulk investment and walk away or follow more of a common DCA strategy? Choose what you think works best for you.

One last thing I would like to share is the liquidation process. I made the official request on October 3, 2023 and my request was processed on January 4, 2024. That’s right, just over 3 months.14 It unfortunately, just so happened that nearly $1,000 in value of my account was lost between when I requested liquidation and my request being processed. Again, I chuck this up to timing and it does go back to my personal investing style and the ability to have greater control and flexibility. The ACH to transfer funds was processed only a couple days later15. It was known to me that it would take time to process a liquidation and reality is the total time really just depends when you make the request, as all redemptions are evaluated in the beginning of the next quarter. Something I was not aware of (which entirely is my own responsibility- Fundrise does make you aware of this), the value of your portfolio for redemption is determined by the last day of the quarter in which you requested the redemption- not the day you request it. Someone did reach out to me to let me know that during the liquidation request you are also informed of this as well.16 I felt I found the perfect time to exit to stop the bleeding, but it turns out my account bled more and I all could do was sit and watch. This again, goes back to my comment on greater flexibility and control. My personal circumstance, this was not really an issue nor did it create a hardship- but just something to make sure you’re aware of.

It was a great experience while it lasted, but it’s time to move on and re-invest my money where I’ll gain that greater flexibility and control that fits my personal investing style. Of course, I’ll keep rooting for Fundrise to be successful- especially since I will keep my iPO funds in the platform in hopes one day it provides a positive return as a “long-term investment”.

Happy investing!

Clarifications and Revisions

- 6 Jan 2024 correction; I originally stated I’m liquidating everything, which is not valid. I have liquidated the eREITs funds and the Innovation fund. ↩︎

- 7 Jan 2024 update; The entire net contribution invested over the 5 tears was not at a one-time bulk contribution, but rather a gradually increasing monthly contribution amount. This info was always stated, but I wanted to explicitly make clear a one-time bulk investment was not done. ↩︎

- 7 Jan 2024 update; After additional discussions with other Fundrise investors who started investing around a similar time and did a one-time bulk contribution up front is now positive. ↩︎

- 7 Jan 2024 update; I did not mention previously the investment plan that was selected. ↩︎

- 7 Jan 2024 update; Previously I did not have the funds (or allocation) listed. Updated to include. ↩︎

- 7 Jan 2024 update; After spending a lot more time going through past statements and analyzing the performance of several funds, I added additional context and details. ↩︎

- 7 Jan 2024 update; Previously I stated “in good conscience, there’s no way I could recommend Fundrise to them”. I stand corrected, as this statement is way overreaching and not valid. ↩︎

- 5 Jan 2024 update; I updated the entire comparison section below to be more accurately aligned with the actual performance of my personal Fundrise portfolio. I previously had a very simple hypothetical example, comparing only the net return percentage of my Fundrise portfolio vs RWR and VOO price performance only for a similar timeframe using a fixed starting balance, however there seemed to be many people struggling with this. You can view the original comparison I had here. Admittedly, I was lazy with actually putting together a decent and valid comparison originally. So, this has been updated below. The simple fact does not change at all- the performance of my personal Fundrise portfolio would have underperformed against RWR or VOO under similar conditions and timeframes (trailing 5 years). ↩︎

- 8 Jan 2024 update; Re-reading some past Fundrise annual letters I notice something interesting- how they strategically benchmark themselves against the market when it works in their favor. ↩︎

- 8 Jan 2024 updated; I did previously state “my issue”. Which is inaccurate, it’s more of my personal concern. ↩︎

- 8 Jan 2024 correction; This originally did not read correctly or make sense, was updated to be more clear. ↩︎

- 6 Jan 2024 correction; I did mention there was a “conflict of interest” which did not make sense in the context of the sentence. ↩︎

- 8 Jan 2024 update; Added the additional info on the iPO annual letter ↩︎

- 04 Jan 2024 correction; I provided the correct months (Oct through Jan), but the incorrect number of months was mentioned. It was 3 months, not 4. Thanks Max for the comment and correction. ↩︎

- 8 Jan 2024 update; Since major updates to this post, the funds from the redemption have been processed. ↩︎

- 8 Jan 2024 update; Thanks again to Max for the comment on this. ↩︎

I agree – FR isn’t for everyone, me included. I have stopped auto-investing and reinvesting dividends but waiting for my losses to be recouped. But I think your post is totally inaccurate.

When you go through the liquidation process, FR tells you when & how the funds will be processed.

You requested it in Q4 (Oct) and they completed the process at the end of Q4 (which isn’t over four months) which is mentioned when redeeming your shares. The same goes for how they process the share value. It specifically mentions it throughout the redemption process plus there’s a checklist you have to go through.

Thanks for engaging! And yeah, I’m certain things will balance out in your account and if hanging on for the long-run things will go positive- it’s just a matter of time.

I think stating the “post is totally inaccurate” is a stretch. For starters, it was 3 months and not 4. This typo is the only inaccuracy I’m aware of in my post. Thank you very much for pointing this out! I’ve made this correction and corresponding annotation. Thanks!

“FR tells you when & how the funds will be processed”, I’m not so sure I agree with this statement. I’m not sure if you had a different experience or not. I submitted my redemption request on Oct 3, 2023 and received an email the same day stating “Early January expected review date”. The email listed all funds and number of shares requested and also mentioned “We expect to review and process redemption or repurchase requests as normal for the following funds. However, eREITs, the eFund, or the Innovation Fund may suspend redemptions at any time, and as always, there can be no guarantee that your eREIT or eFund redemption requests will be approved.” That’s it- nothing more, nothing less and no forms of communication in between.

I’m honestly not sure what you mean by “The same goes for how they process the share value. It specifically mentions it throughout the redemption process plus there’s a checklist you have to go through”. I definitely would not say there’s anything “throughout the redemption process”- I would not consider “Early January expected review date” as any type of specific info and they communicated “there can be no guarantee that your eREIT or eFund redemption requests will be approved”. Honestly, I don’t recall a checklist- I can only recall making the request online and that’s it. I felt it was a simple straight forward process to request the redemption. Maybe there was a difference between your experience and mine based on the funds being redeemed? I’m not sure.

The redemption request was processed on January 4, 2024. Outside of the typo of 3 vs 4 months, I’m not sure that would qualify as my post being “totally” inaccurate. Additionally, just in case, I was told the funds would actually hit my account 6 to 10 business days after the process date of Jan 4th. So, we’ll see actually long the process took for me. I’m stating plain facts of my experience. Also, I am not stating all redemptions will take a similar timeframe in my post for all investors- I’m speaking to my experience based on the dates I shared. I also mentioned in my post “It was known to me that it would take time to process a liquidation”, so I was not expecting the funds in quick order at all. Due to my own ignorance, I did not know the value of my shares requesting to be redeemed would be valued at the end of the requesting quarter, versus the date in which I made the request.

Otherwise, I did enjoy investing with Fundrise- especially reading through all of the analysis of the actual properties going to be invested in. I also have a continued vested interest in them with the very small amount of iPO shares I still own. But similar to you, Fundrise is simply not for me.

I take back my “totally inaccurate” comment. But there are inaccurate (not totally) comments you make about the redemption process.

I pretended I was redeeming shares and saw the “checklist” I was referring to. I couldn’t screenshot it because it wouldn’t let me but one box was “I expressly acknowledge that, with respect to any shares requested to be repurchased of the funds…, the net asset value of the shares requested may fluctuate between the date of this request and the date I receive any funds pursuant to this request, and therefore the amount I can expect to receive pursuant to this request will not be known until after I can no longer rescind such request.”

There is also a bunch of other statements plus screens you have to go through which I was referring to about the redemption process that someone has to go through.

BUT, not to create a back & forth, your post is and will be helpful to most people who are interested in or already part of FR. It gives a good in-depth look at real investing also which was informative.

Ahh! Ok, I honestly can’t remember the process. So, thank you very much for sharing that!

Otherwise, I do greatly appreciate your time, feedback, and engagement! I hope you have a great new year!!

I appreciate you taking the time to write your personal experience. Most of the internet is also rooting for FundRise alongside you, and I have been looking into it. Your article helps a lot with my research!

Have you heard of Tellus or CompoundBanc?

Thank you! I have not heard of Tellus or CompoundBanc- I’ll have to look into them.